loading...

If you’ve been following India’s semiconductor journey, the past few months have been nothing short of transformative. Prime Minister Narendra Modi’s recent visit to Japan in August 2025 injected fresh energy into India’s ambition of becoming a global semiconductor hub. This was not just another diplomatic handshake tour it delivered concrete investment pledges, strategic agreements, and a renewed focus on technology collaboration between two of Asia’s most influential economies.

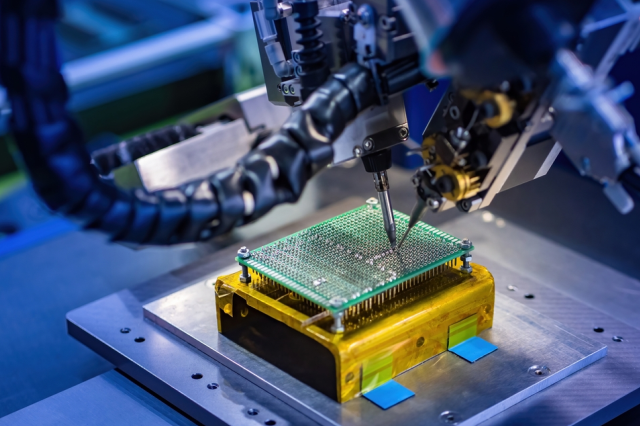

As clear as daylight, semiconductors are the brains of all modern technology. Yet the silver lining comes with a cloud the world continues to face a major chip shortage even as demand skyrockets. As the demand for semiconductors grows exponentially, nations are scrambling to secure their place in the global value chain. India, with its vast engineering talent, growing electronics consumption, and supportive policy ecosystem, is positioning itself as a credible contender. And Japan, home to world leaders in semiconductor equipment, raw materials, and R&D is stepping in as a powerful ally.

PM Modi’s two-day state visit to Tokyo on August 29–30, 2025 has been hailed as a landmark moment in the India-Japan semiconductor partnership. Here are the highlights:

Investment Commitments Double

Japan’s government and private sector announced a massive increase in investment plans for India, raising the target from ¥5 trillion to ¥10 trillion (approximately USD 68 billion) over the next decade. This is one of the biggest commitments in the history of India-Japan economic relations and will be a game-changer for the Make in India electronics and semiconductor manufacturing ecosystem.

Economic Security Initiative

A joint framework was launched to strengthen supply chain resilience in semiconductors, critical minerals, clean energy technologies, and advanced telecommunications. Given the geopolitical tensions that have disrupted global supply lines, this initiative puts India and Japan at the center of a more secure, Asia-driven value chain.

21 Strategic Agreements

A total of 21 MoUs and agreements were inked, spanning semiconductor fabs, AI, digital transformation, startup ecosystems, and rare earth material cooperation. This lays out a decade-long roadmap of collaboration in high-tech sectors.

People-to-People Collaboration

The leaders announced a human capital initiative that will see 500,000 Indian students, researchers, and professionals engage in knowledge exchanges, internships, and training programs in Japan over the next five years. This is expected to build a strong talent pipeline for chip design, semiconductor fabrication (fab) plants, and allied industries.

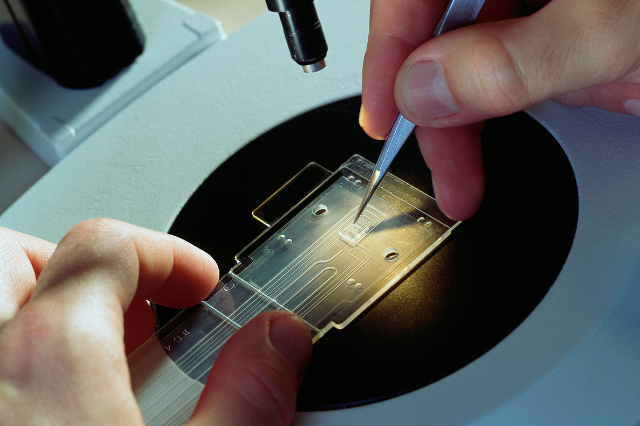

Visit to Tokyo Electron’s Facility in Sendai

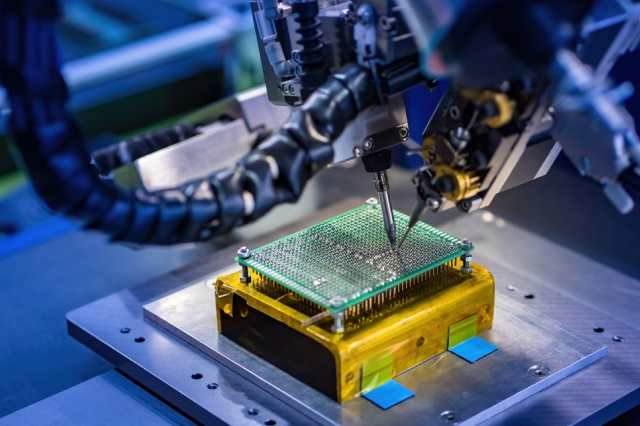

PM Modi, along with Japanese Prime Minister Shigeru Ishiba, visited the advanced Tokyo Electron semiconductor manufacturing plant in Sendai. The tour symbolized India’s hands-on commitment to learning and adapting cutting-edge chipmaking technologies.

Japan’s role in the global semiconductor industry is both unique and indispensable. Consider these facts:

Tokyo Electron is one of the world’s top suppliers of chipmaking equipment, providing machines critical to lithography and wafer processing.

Sumitomo Chemical leads globally in photoresists and silicon wafers—materials that are the backbone of semiconductor manufacturing.

Renesas Electronics is a global leader in microcontrollers and automotive chips, both essential for the EV and IoT boom.

Japanese companies control nearly 35% of the global market share in semiconductor materials—areas where India still lacks domestic capacity.

This makes Japan not just a partner, but a technology anchor for India. By combining Japan’s expertise in equipment and materials with India’s low-cost engineering talent, policy incentives, and vast domestic market, the two countries can build a mutually beneficial and globally competitive supply chain.

The benefits for India’s semiconductor sector are far-reaching:

Boost to ‘Make in India’

With Japan’s investments, India could significantly reduce its annual semiconductor import bill, currently estimated at over $15 billion, by producing chips domestically for smartphones, consumer electronics, and automobiles.

Creation of High-Value Jobs

A single semiconductor fab can create 2,000–5,000 direct jobs for engineers and technicians, while ancillary ecosystems in chip packaging, testing, and logistics generate tens of thousands of indirect opportunities.

Technology Transfer

India stands to gain from Japan’s leadership in high-purity chemicals, wafer technology, and precision equipment, shortening its learning curve by years.

Enhanced Global Credibility

India has already attracted big names like Micron (ATMP plant in Gujarat), Foxconn-Vedanta (fab project), AMD (new R&D campus in Bengaluru), and Lam Research ($1 billion investment). Japan’s entry deepens this ecosystem and positions India more credibly in global supply chains.

The India-Japan semiconductor collaboration must be viewed against the broader global realignment. The US, EU, Taiwan, and South Korea have already announced more than $200 billion in subsidies to secure domestic chipmaking capabilities.

India responded with the ₹76,000 crore (USD 10 billion) Semicon India Program, offering up to 50% financial support for setting up semiconductor fabs, design centers, and OSAT units. With Japan’s active involvement, these incentives are now more likely to attract first-mover mega fabs and research parks.

In addition, both countries are expanding cooperation in rare earth elements, which are critical for chip and EV battery manufacturing. This ensures not just growth, but also geostrategic security in a sector vulnerable to political disruptions.

Experts predict several outcomes in the next 3–5 years:

Joint semiconductor parks in Gujarat, Tamil Nadu, and Karnataka, leveraging Japanese technology and Indian infrastructure.

Skill development programs co-designed by Japanese chip companies to train Indian engineers for fab operations.

Collaborative R&D in automotive chips, EV electronics, and industrial IoT solutions.

Potential fab announcements where Japan’s materials and equipment ecosystem will play a crucial role.

If executed effectively, these steps will cement India’s place as a semiconductor powerhouse in Asia, while allowing Japan to expand its Indo-Pacific influence and hedge against supply chain vulnerabilities.

While Japan is taking the lead, India’s semiconductor dream will also draw strength from other Asian economies:

South Korea: With giants like Samsung and SK Hynix dominating memory chips, South Korea is likely to collaborate with India on memory fab units and foundry services. The Korean government’s plan to build the world’s largest chip cluster by 2027 opens the door for cross-border projects with India.

Taiwan: As the undisputed global leader through TSMC, Taiwan may explore India for design partnerships, research parks, or joint fabs, particularly as part of its strategy to diversify beyond the Taiwan Strait.

Malaysia: Known as the world’s OSAT hub, contributing nearly 13% of global semiconductor packaging and assembly, Malaysia could partner with India to strengthen the back-end manufacturing ecosystem, enabling India to scale rapidly.

Together, these investments signal a pan-Asian shift toward India as a semiconductor hub. With diversified partnerships, India could integrate into every stage of the chip value chain—from R&D and design to fabrication, packaging, and testing.

The India-Japan partnership is more than a bilateral deal—it is a geopolitical and technological realignment. For India, this collaboration reduces dependence on imports, creates high-value jobs, and integrates the country into the global semiconductor supply chain. For Japan, it expands its tech footprint in the Indo-Pacific and secures long-term strategic resilience.

The semiconductor industry is the backbone of the digital economy, and India has now positioned itself at the center of Asia’s most promising collaborations. The coming years will show whether these bold commitments translate into silicon on wafers, but one thing is clear: the momentum is unstoppable.

India’s semiconductor story has just begun, and with partners like Japan, South Korea, Taiwan, and Malaysia, the future looks not just bright but electrically charged.

A to Z on India, Japan & the Future of Semiconductor Industry: A New Chapter in Tech Collaboration

A to Z on India, Japan & the Future of Semiconductor Industry: A New Chapter in Tech Collaboration

RTL Design vs Physical Design: What's the Real Difference?

RTL Design vs Physical Design: What's the Real Difference?

The Future of the Semiconductor Industry: What Indian Students Should Know

The Future of the Semiconductor Industry: What Indian Students Should Know

Top 7 Career Paths After Completing a VLSI Course

Top 7 Career Paths After Completing a VLSI Course

Best Time Management Tips for Students Preparing for VLSI Careers

Best Time Management Tips for Students Preparing for VLSI Careers

Mastering VLSI Physical Design: A Comprehensive Course Overview

Mastering VLSI Physical Design: A Comprehensive Course Overview

The Complete FPGA and ASIC Guide

The Complete FPGA and ASIC Guide

Verilog Essentials: Mastering the Fundamentals of Hardware Description Language

Verilog Essentials: Mastering the Fundamentals of Hardware Description Language

Unleashing the Power of System Verilog: A Comprehensive Guide for Aspiring Designers

Unleashing the Power of System Verilog: A Comprehensive Guide for Aspiring Designers

Demystifying VLSI chip Design: Exploring the Core Concepts of VLSI Courses

Demystifying VLSI chip Design: Exploring the Core Concepts of VLSI Courses

Basics of VLSI - An Ultimate Guide

Basics of VLSI - An Ultimate Guide

Career Prospects After Completing A VLSI Course

Career Prospects After Completing A VLSI Course

Top 5 Reasons To Take Up A Professional VLSI Course

Top 5 Reasons To Take Up A Professional VLSI Course

Mastering VLSI Design: A Comprehensive Guide To Understanding Complex Integrated Circuits

Mastering VLSI Design: A Comprehensive Guide To Understanding Complex Integrated Circuits

Future-Proof Your Career With A VLSI Course: How Learning About Integrated Circuits Can Boost Your Job Prospects?

Future-Proof Your Career With A VLSI Course: How Learning About Integrated Circuits Can Boost Your Job Prospects?

System Verilog: An Overview

System Verilog: An Overview

Introduction to Hardware Description Language (HDL)

Introduction to Hardware Description Language (HDL)

Unlock The Potential Of VLSI Design With An Integrated VLSI Course Online

Unlock The Potential Of VLSI Design With An Integrated VLSI Course Online

Universal Verification Methodology:An Efficient Verification Approach

Universal Verification Methodology:An Efficient Verification Approach

How to Write a Verilog Module for Design and Testbench

How to Write a Verilog Module for Design and Testbench